Although qualifying for a mortgage as an investor involves many of the same basic considerations as if you were purchasing the home for yourself, you may find that there is limited information online specific to purchasing a rental or investment property.

Although qualifying for a mortgage as an investor involves many of the same basic considerations as if you were purchasing the home for yourself, you may find that there is limited information online specific to purchasing a rental or investment property.

In upholding our three core values - freedom, family, and time - our aim is to ensure you are equipped with all of the information you need to make informed decisions. To help move you along the right path, we’ve put together a few of the top factors to consider when you are looking at rental properties.

Investment Property Type

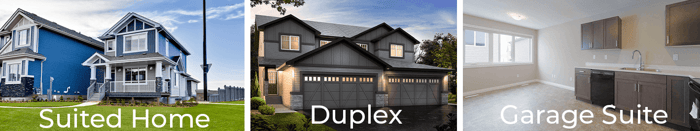

The type of investment property you are considering can have a significant impact on the mortgage qualification process. Smaller properties are considered to have between one to four rental units and are zoned as residential. Suited homes, duplexes, and homes with garage suites are three examples of residential investment properties.

The other type of investment property is a large, multi-unit building. This type of property has at least five units, however, there may be upwards of fifty units in a single building. These types of properties are zoned as commercial and generally come with a much heftier price tag. Qualifying for a commercial mortgage involves a different process than residential.

Type of Mortgage

Residential mortgages, as a general rule, tend to have lower interest rates and less strict lending requirements than commercial. Because you are generally required to have at least 15 percent down on a commercial mortgage, you will need a larger amount of funds available for your down payment. Additionally, only certain lenders offer commercial mortgages, so check with your Mortgage Broker to ensure you are able to find the right product for your needs.

Owner Occupancy

Whether or not you plan on living in the investment property can have a substantial impact on the amount of down payment that is required. Lenders perceive owner-occupied properties as less of a risk, and you may be able to qualify for a mortgage with as little as five percent down.

For example, if your property has two units and you are living in one of them, it’s possible for both units to be on the title. This means you could purchase both of them for five percent down (with a purchase price of less than $500,000). If the total mortgage is more than $500,000, you will need a down payment of five percent on the first $500,000 (which equates to $25,000), plus ten percent of the remaining amount. If the property is over $1,000,000, twenty percent down is always required.

Mortgage Amortization

Mortgage Amortization

In most cases, lenders will require you to amortize your mortgage over twenty-five years or less. However, if you are paying 20 percent (or more) down, you may be able to qualify for a thirty-year amortization. Remember, the shorter your amortization, the more you will pay per month; however, you will also save in interest over time.

Additional Considerations

Lenders will always look for available down payment funds, good credit, and proof that you are able to take on additional debt before approving your mortgage application. For an in-depth look at the qualification process, our friends at Innovative Mortgage Solutions have broken down what lenders look for in a mortgage application for you.

While the ideal situation involves having all of your rental units fully occupied, vacancy is a possibility you will need to be prepared for. You are responsible for making your mortgage payment on all properties whether the unit is rented or not, so lenders will pay close attention to your debt versus the amount of money you have coming in when qualifying you for a mortgage. They will take a look at the income you are earning through your employment, and they may also consider any investment income you have coming in through additional properties.

The details of real estate investing can be challenging to understand, which is why we are always available to you to answer any questions you may have. Keep an eye out for our next blog, which details down payment requirements for investment properties. Or, if you prefer to chat with someone in the meantime, simply fill out the contact form on our website and we will be in touch with you shortly.

Photo credits: depositphotos.com

This article is a guest post from Innovative Mortgage Solutions. You can get more valuable mortgage information from them by checking out their blog.